Opening a zero balance account can be a smart financial decision, especially if you want a hassle-free banking experience with minimal requirements. Mashreq Bank, one of the leading banks in the UAE, offers a Zero Balance Account option that comes with plenty of benefits for residents. This guide will walk you through the steps to open a Mashreq Zero Balance Account, eligibility requirements, benefits, and more.

Contents

What is the Mashreq Zero Balance Account?

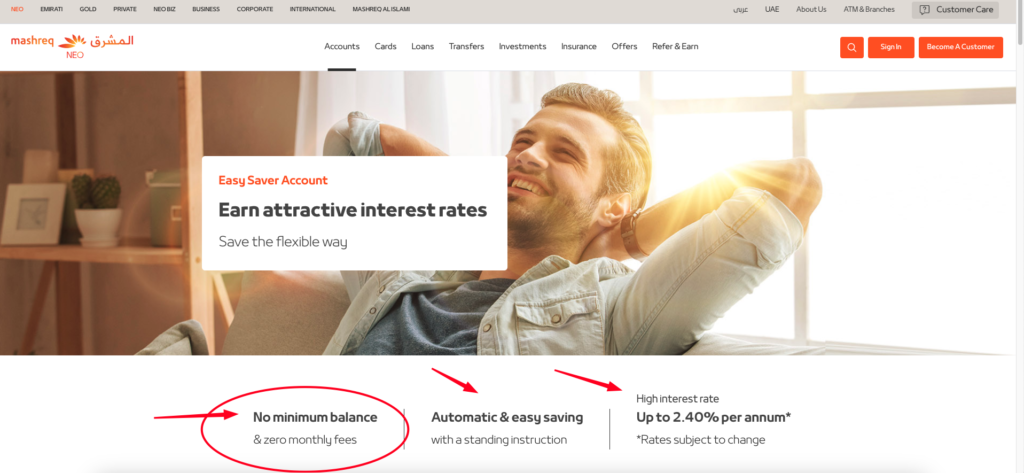

The Mashreq Zero Balance Account is a type of bank account that doesn’t require you to maintain a minimum balance. This is particularly useful for those who want flexibility and don’t want to worry about monthly maintenance fees or balance requirements. The account offers several benefits, including easy online banking access, debit card options, and no penalties for low balances.

Benefits of Opening a Mashreq Zero Balance Account

Why choose the Mashreq Zero Balance Account? Here are some of the top advantages:

- No Minimum Balance Requirement: With this account, you don’t have to worry about maintaining a certain balance, which is ideal for students, freelancers, and anyone on a budget.

- Digital Banking Services: Manage your finances on the go with the Mashreq mobile app and online banking platform.

- Debit Card Access: Enjoy easy access to ATMs and use your debit card for purchases worldwide.

- No Monthly Fees: Unlike traditional accounts, there are no monthly maintenance fees, making this account affordable and convenient.

Eligibility Criteria for a Mashreq Zero Balance Account

Before you start the application process, it’s essential to understand the eligibility requirements. Generally, the Mashreq Zero Balance Account is available to:

- UAE Residents: You must have valid residency status in the UAE.

- Age Requirements: The applicant should be at least 18 years old.

- Employment Proof: You may need to show proof of employment or salary certificate, depending on the account type and bank’s requirements.

Note: It’s advisable to check with Mashreq Bank for any additional criteria as eligibility may vary.

Step-by-Step Guide to Open a Mashreq Zero Balance Account

Follow these simple steps to open your zero balance account at Mashreq Bank:

Step 1: Visit the Mashreq Bank Website or App

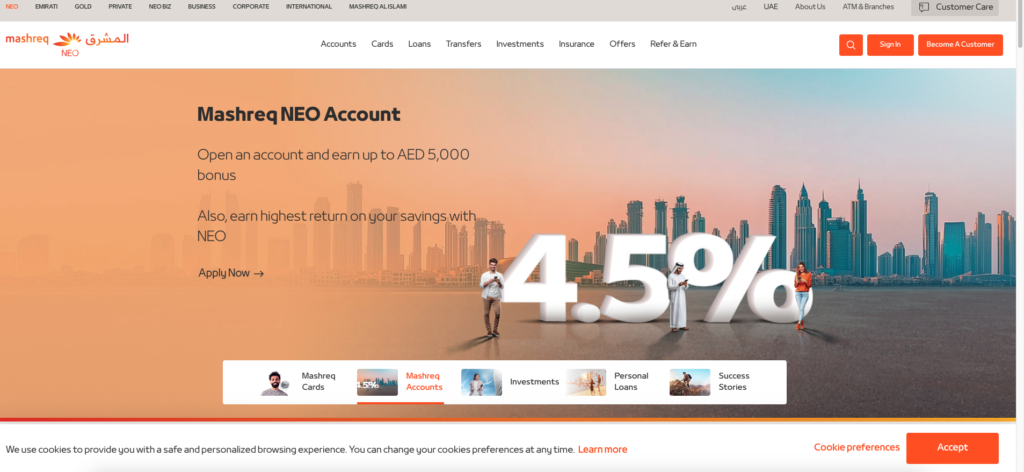

To start, go to the official Mashreq Bank website or download the Mashreq Neo mobile app[download here]. Mashreq has streamlined the account opening process to make it possible entirely online.

Step 2: Select the “Zero Balance Account” Option

Once on the website or app, look for the zero balance account under the “Accounts” section. Select it to start the application.

Step 3: Complete the Online Application Form

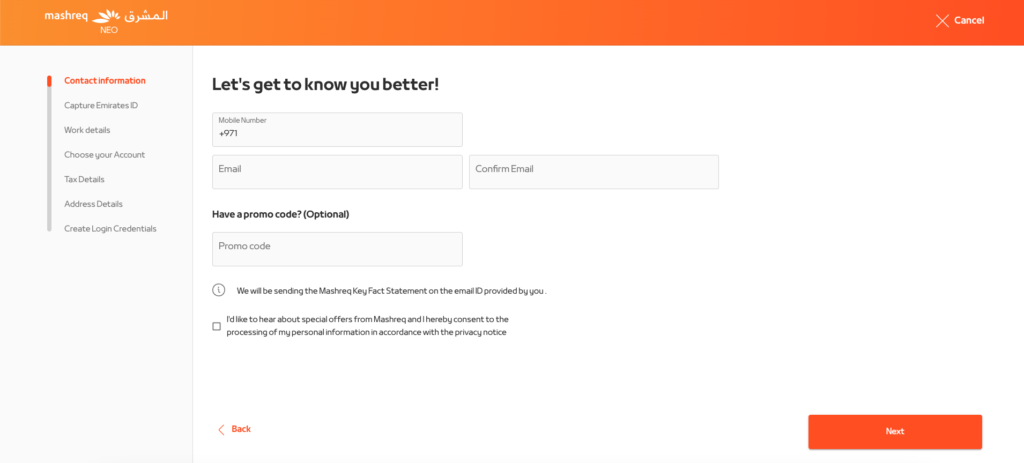

Fill in your personal information (name, contact details, Emirates ID number) and employment information. This is typically straightforward and should only take a few minutes.

Step 4: Submit Required Documents

Upload the necessary documents, including:

- Emirates ID: A valid Emirates ID for identification.

- Passport Copy (if required)

- Residence Visa Copy (if applicable)

- Salary Certificate or Employment Proof (may be required based on the account type)

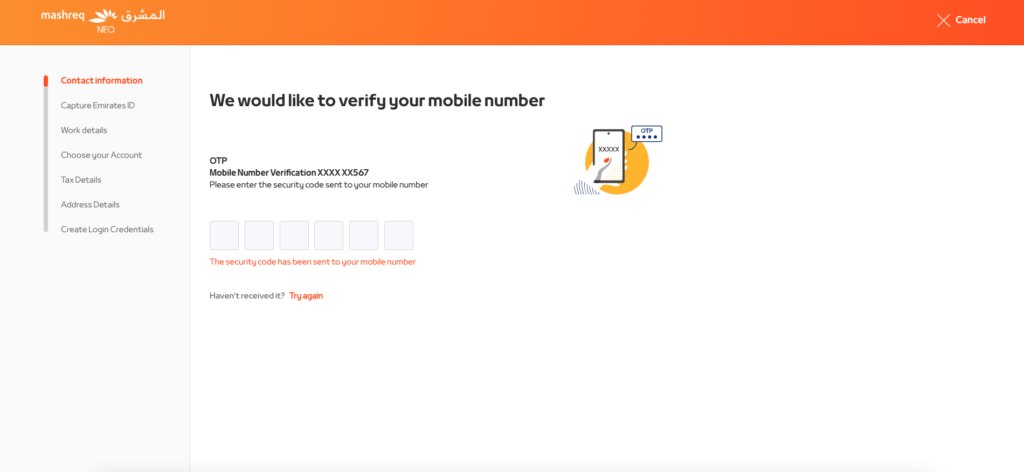

Step 5: Verification Process

After submitting your application, the bank will review and verify your details. This process usually takes a few business days. You may receive a call or email from the bank if they need any additional information.

Step 6: Receive Your Debit Card and Account Details

Once approved, you’ll receive your debit card and account details. You can now start using your Mashreq Zero Balance Account for transactions, savings, and payments.

Read: How to Check Your Mashreq Bank Balance

Frequently Asked Questions (FAQs)

1. Can I open a Mashreq Zero Balance Account without visiting a branch?

Yes, Mashreq offers an online account opening process, so you don’t need to visit a branch. You can complete the entire process on their website or through the Mashreq Neo app.

2. What documents are required for the Mashreq Zero Balance Account?

The primary documents required include your Emirates ID, passport copy, and proof of employment. Requirements may vary, so it’s best to check with Mashreq Bank directly.

3. Are there any hidden fees with the Mashreq Zero Balance Account?

There are no monthly maintenance fees or balance requirements with the zero balance account. However, specific transaction fees may apply based on your usage, so it’s a good idea to review the terms and conditions.

Final Thoughts

The Mashreq Zero Balance Account is a convenient and accessible banking option for UAE residents looking to avoid the hassle of maintaining a minimum balance. With easy online access and a quick setup process, it’s perfect for individuals who want a flexible and low-maintenance account.

Opening a zero balance account with Mashreq Bank can be the right step toward simplifying your finances. Follow the steps outlined above to start your journey with Mashreq Bank today!